By Lance Mihm

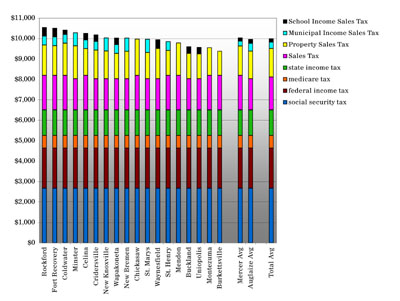

lmihm@dailystandard.com Rockford residents will have the highest tax burden in Mercer and Auglaize counties this year.

Fort Recovery, Minster and Coldwater also rank near the top, with Burkettsville residents paying the lowest taxes.

The findings are a result of a Daily Standard study of taxes to be paid per household in each community this year, based on an average-sized family in the two-county area with an average-value home and household income.

To get an average tax burden for each community, the amount of taxes being paid in the two-county area was divided by the number of people for the per capita averages and by the number of households for the household averages. Household incomes may involve two or more earners and/or two or more jobs per earner.

The average household income used in the calculations was $42,742 in Mercer County and $43,367 in Auglaize County. The average home value in Mercer was $94,000 and $90,600 in Auglaize, and the average-sized family was 2.68 persons in both counties combined. The information was extracted from the U.S. Census of 2000. The results showed an average income of $43,055 and an average home value of $92,300. To give a whole number, average people per household was rounded up to three.

Taxes used to determine the tax burden were those that come out of taxpayers' paychecks, including Social Security, Medicare, federal, state, school and local income taxes. The rest was determined by state mandated and locally approved property taxes and from sales taxes.

Gas taxes were not included.

Sales taxes paid were based on 7 percent of total retail sales per capita, times three to account for each person in the household. The average amount of taxable goods to be purchased this year per capita is $7,281 in Auglaize County and $8,057 in Mercer County, calculations show.

Social Security Tax and medicare taxes were based on the current 6.2 and 1.45 percent that is charged, and federal and state income taxes were based on what taxpayers were responsible for according to the 2004 1040A federal and state tax booklets.

Rockford ended up at the top of the 18 incorporated towns by having one of the top millage rates of 46.14143, which includes school mills, followed up by a 1 percent municipal tax and a 1 percent school income tax. The average household in Rockford will spend $10,548.38 in property, income and sales taxes, or 24.50 percent of the average income.

In contrast, Burkettsville residents have the lowest millage at 36.7254 and no local income taxes. The total tax burden this year for a Burkettsville household will be about $9,383.09, representing 21.79 percent of the average household income and 11.05 percent lower than Rockford.

Of the total amount of state and federal taxes, each local household will pay on average $1,964 in federal income tax, $2,669.41 in social security tax, $624.30 in medicare tax and $1,247 in state income tax.

Average taxes to be paid based on home values and household income over the two-county area in the other communities will be:

¥ Fort Recovery, $10,511.66 or 24.41 percent of household income in the village.

¥ Coldwater, $10,415.72 or 24.19 percent of average income.

¥ Minster, $10,287.35 or 23.89 percent of average income.

¥ Celina, $10,256.74 or 23.82 percent of average income.

¥ Cridersville, $10,184.74 or 23.66 percent of average income.

¥ New Knoxville, $10,033.64 or 23.30 percent of average income.

¥ Wapakoneta, $10,026.66 or 23.29 percent of average income.

¥ New Bremen, $10,022.76 or 23.28. percent of average income.

¥ Chickasaw, $9,971.23 or 23.16 percent of average income.

¥ St. Marys, $9,964.33 or 23.14 percent of average income.

¥ Waynesfield, $9,942.92 or 23.09 percent of average income.

¥ St. Henry, $9,850.09 or 22.88 percent of average income.

¥ Mendon, $9,785.12 or 22.73 percent of average income.

¥ Buckland $9,595.63 or 22.29 percent of average income.

¥ Uniopolis $9,573.41 or 22.44 percent of average income.

¥ Montezuma $9,557.27 or 22.20 percent of average income.

The average household in Mercer County would pay $10,031.03 in various taxes per year and $9,959.05 in Auglaize County.

The numbers put the average Mercer-Auglaize County resident lower on the tax burden list compared to both state and national averages. Ohioans, according to the Tax Foundation, based in Washington, D.C., will pay 27.5 percent of their salaries in taxes this year, slightly above the national average of 26.3 percent. Auglaize and Mercer County residents on average pay 23.21 percent of their salaries in taxes.

The differences can be attributed to predominately more exemptions. While area residents averaged slightly above state and national averages in household income, the number of residents per household (2.68) ranked above the national (2.43) and state (2.49) averages, which equated into Auglaize-Mercer residents having a 10 percent advantage in exemptions nationally and 8 percent statewide due to larger families.

Another contributing factor was the average home value, which was $11,400 below the state average of $103,700.

The findings did not take into consideration municipalities that may have higher incomes or property values. For instance, the average appraisal of homes in Minster is likely higher than Montezuma. As household incomes or property values go up or down, percentages can vary slightly.

Based solely on local taxes, which do not include federal taxes, Mercer-Auglaize residents will pay 11 percent of their income to local taxes, slightly below the state's average of 11.3 percent.

This gave area residents a Tax Freedom Day of March 26, 14 days ahead of the national average of April 10. Tax Freedom Day is when residents have earned enough money to satisfy their total tax bill for the year.

Burkettsville residents reach-ed that date earliest, March 21, while Rockford and Fort Recovery residents worked the longest, March 31 to pay their taxes. |